Why Free, Ad-Supported Streamers Are Beating Out Competitors Like Netflix

By Movieguide® Contributor

Free, ad-supported, streaming television is continuing to beat out bigger, subscription-based competitors.

“For the second month in a row, Tubi, the Roku Channel and Pluto TV collectively accounted for a bigger share of television (4.3%) than the combined total of Max, Paramount+ and Peacock (3.7%),” Yahoo! Tech reported.

In fact, Tubi’s 14.7% growth from May was nearly identical to Disney+’s growth from that same month.

So, what accounts for FAST (free, ad-supported, streaming television) channels’ major growth?

“It has been a long time coming,” Andrew Rosen, a former Viacom executive, told Deadline. “What FASTs are ultimately proving in the wake of Netflix’s success is that the product and viewing experience matters as much, if not more, than the content being watched. FASTs are increasingly winning because they are products first, and walled gardens for content last.”

While the fact that these channels are free is the major draw, that isn’t the only thing keeping viewers around.

“Free is a great driver to get people to try something,” John Buffone, vice president and media entertainment industry adviser at market research company Circana, told The Hollywood Reporter. “Free doesn’t keep you there.”

Viewers are responding to the massive libraries services like Tubi offer, as well as the diversity of their content.

“We have hundreds of Korean dramas. We have hundreds of UFO docs. If you want to watch silent films or anime, we have that. And so what we’re finding is these fandoms are really kind of discovering what’s happening at Tubi and that’s driving that viewership,” Tubi CEO Anjali Sud told THR.

Some even think this might decrease the value of streamers like Netflix, Hulu and Max.

“As long as the tech and user experience of FASTs are better than the paid products, then questions about the value of Disney+/Paramount+/Max are going to grow,” Rosen said. “Why do these services exist if they cannot get target customers to pay to watch their libraries?”

Movieguide® previously reported on Tubi’s popularity:

While Tubi doesn’t enjoy the studio backing most streaming services rely on, strategic licensing has allowed the free service to become an unexpected player in the industry.

Last month, Tubi was the fifth most popular streaming service, accounting for 1.6% of all TV usage in America. This put it on par with Disney+ (1.7%) while beating out more recognizable names such as Max (1.3%), Peacock (1.3%) and Paramount+ (1.0%). While these numbers are a far cry from the industry titans of YouTube (9.7%) and Netflix (8.1%), they still represent an incredible rise from a platform that has taken a different approach to the streaming world.

As a FAST (Free Ad-Supported TV) channel, ads have been at the center of Tubi’s strategy from the start, allowing it to compete with the bigger platforms that have only started to offer ad-supported options within the past year. This massive rise in demand has made it a marketer’s world, leaving the platforms with less experience floundering to land favorable deals.

While a library built on older movies may seem unappealing for younger generations, Tubi has the youngest median age viewership in TV at only 39 years old. To continue to capitalize on this younger audience, who are likely choosing Tubi to save costs, the streamer started to funnel its resources for original content into TikTok and YouTube creators.

“I think Tubi has an opportunity, the scale, and a unique business model and the momentum to shape the future of entertainment, and those opportunities don’t come along often,” Tubi’s CEO, Anjali Sud, told The Verge. “And so it just felt like an exciting time, and after spending so much time thinking about creators, I’m excited to help connect the dots between that ecosystem and audiences and how we build for them in the future.”

Questions or comments? Please write to us here.

- Content:

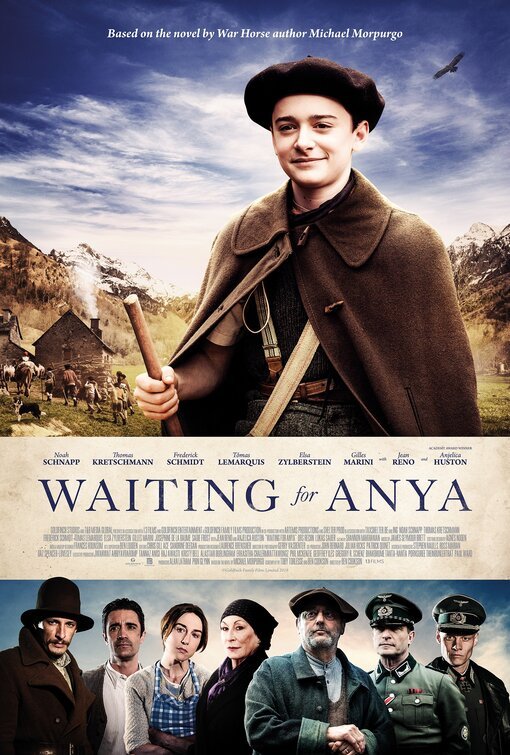

- Content:

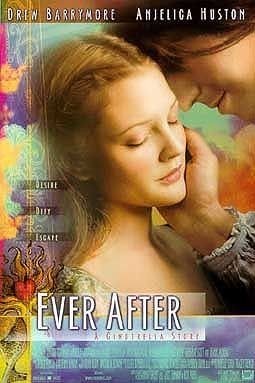

– Content:

– Content: