Is $250 Million Worth It for a Theater-Released Movie? Only Amazon Thinks So.

Movieguide® Contributor

Christmas action movie RED ONE cost $250 million to make — this might have made sense during COVID when streaming dominated, but now? Not so much.

“After the movie opened last weekend in the U.S. to a less-than-festive $32 million (revised downward from an estimated $34 million on Sunday), folks close to Amazon, the e-retailer turned aspiring media giant, insisted the movie was successful,” Variety reported Nov. 21. “It didn’t matter that it would take a Christmas miracle for RED ONE to ever get out of the red during its theatrical run. And who cares that JOKER: FOLIE À DEUX was declared a folie à dud when the Warner Bros. sequel opened to $38 million a few weeks prior, despite costing $50 million less than READ ONE.”

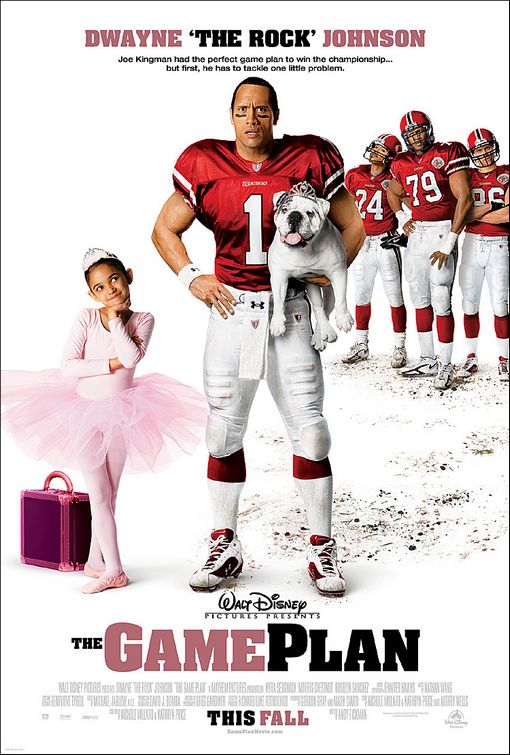

The movie’s audience scores are a bit better than Dwayne Johnson’s BLACK ADAM. “Comscore/Screen Engine audiences were harder, with 78% positive, 57% definite recommend, with kids under 12 better at 91% and 51% must-see right away,” Deadline reported.

“The idea was that all of the attention surrounding the movie’s big-screen release would ensure that a vast audience tunes in when RED ONE debuts at some point on the company’s streaming service Prime Video, in turn bolstering subscribers or keeping them from shedding the service for another,” Variety added.

The Rock was also supposed to bring on some ancillary revenues from third-party licensing agreements. But this “movie math” isn’t adding up. Giving more importance to “downstream revenues” instead of box office numbers just doesn’t make a lot of sense.

“I think RED ONE is the exception, not the rule going forward,” said Eric Handler, an analyst at Roth Capital Partners. “The economic model was set up pre-COVID. But everyone realizes you can’t use a $250 million movie as a loss leader to drive subscribers because you can’t justify the return.”

However, Amazon thinks the movie may draw attraction to Prime Video for many Christmas seasons going forward.

READ MORE: WILL THIS CHRISTMAS MOVIE RESCUE THE BOX OFFICE?

“It’s possible that RED ONE will be all that Amazon hoped and dreamed it would be in 2021 when the company prevailed in a ‘highly competitive bidding war’ for the rights to the package,” Variety said. “But the timing of that deal was instructive. It was inked at a time when CAA, WME and talent agencies of their ilk were getting wildly inflated prices for scripts of widely varying quality with A-list stars and directors.”

Amazon inked the RED ONE deal nine months ahead of its procurement of MGM.

“With that deal, the company got access to a vast library of classic films, from SILENCE OF THE LAMBS to THE THOMAS CROWN AFFAIR, and thus a fresh arsenal of IP to reboot, reimagine and, every so often, run into the ground. It gave them a reason to not get sucked into too many of these ‘highly competitive bidding wars,’” Variety reported.

“Netflix made these kinds of movies when they first entered the theatrical business, but they don’t anymore,” said David A. Gross, CEO of Franchise Entertainment Research. “Apple has made them too, and they are cutting back.”

With a lot of big-name actors like “The Rock,” Chirs Evans, Lucy Liu, Kiernan Shipka and J. K. Simmons, fees ran high at $20 million each. But “they were adding millions to that in buyouts. Talent was willing to forgo a back-end payday tied to box office grosses and get the money upfront,” Variety said.

This allows studios to put the film on digital platforms quickly. But streamers are more cash-strapped these days. Netflix, for example, is discussing tying in bonuses connected to viewership rather than paying its actors a single large fee.

“What they’re proposing doesn’t make sense right now,” said one anonymous agent. “The [streamers] save a lot of money. But we don’t get rewarded enough in success.”

“It’s impossible to know if financial gambles like RED ONE ever pay off (though the greenlighting of RED ONE TWO would be a clue). But Amazon MGM head of theatrical distribution Kevin Wilson hinted at the studio’s justification for spending big without requiring a lot of ticket sales in return,” Variety wrote. “For big-budget tentpoles from traditional studios, the general rule is the movie needs to generate 2.5 times its production budget to break even at the box office. (That’s because cinemas keep roughly 50% of revenues).”

Amazon MGM looks at things differently. The company considers it a successful win if it just gets back the marketing and distribution costs, which is around $100 million for a movie of this magnitude.

“Whether or not people like it, the value of these movies is different for our business model,” Wilson told Variety. “If we can put these movies out theatrically and cover our P&A [print and advertising] costs, why wouldn’t we? We’re getting a massive marketing campaign that’s being paid for before the film gets to streaming.”

But this kind of accounting assumes the movie will get back the money invested in marketing and distribution, which isn’t guaranteed.

“As a theatrical film, it will lose over $100 million. On the face of it, it doesn’t appear to be a good investment,” Gross says.

“Cinema owners and traditional studios believe Amazon and Apple’s investment in theatrical is good for the health of the movie business. RED ONE, for example, was being developed for Amazon Prime before the studio opted for a theatrical release after strong test screenings,” Variety reported. “To wit, RED ONE earned an A- grade on CinemaScore from moviegoers, a much better marking than the 33% Rotten Tomatoes average from critics.”

“Movie theaters need commercial movies, particularly with studios releasing fewer of them, and they’re not on the hook if a film fails to recoup its budget,” Variety added. “They’re more than happy to serve as a pricey form of promotion for an eventual streaming release.”

Streamers like Apple and Amazon are changing Hollywood. They don’t agree with rating success in box office numbers and like to keep their original streaming movie statistics ambiguous.

“And that’s become a refuge in the case of a movie like WOLFS, which was re-conceived for Apple TV+ instead of cinemas when it became clear that George Clooney and Brad Pitt wouldn’t be able to deliver big ticket sales,” Variety adds. “That’s encouraged movie studios to embrace a new form of opacity.”

“Worried a film like JUROR #2 might not light the box office on fire? No problem. If you’re a studio like Warner Bros., you just release it in many fewer theaters and use that as a justification for not reporting grosses,” Variety said. “After all, studios aren’t legally obligated to share box office information. They do it because it’s been the norm, not the rule.”

Naturally, industry giants also change how movie success is made.

“Studios like Warner Bros. or Paramount are part of large conglomerates, but the financial hit from a flop like FURIOSA: A MAD MAX SAGA or BABYLON is felt in a way it would not be at Amazon or Apple, where making movies and shows is additive, not a core part of how they make money,” Variety says. “Given that Amazon’s market cap stands at $2.1 trillion and Apple’s sits at $3.4 trillion — while those studios are parts of companies with market caps of $24.7 billion and $7.5 billion — they can afford to think of RED ONE or WOLFS as rounding errors.”

“If any other Hollywood studio had to take a $250 million write-down, it would hurt,” said Handler. “Amazon is fortunate that it won’t be noticed.”

READ MORE: PRIME VIDEO COULD BE YOUR ONE-STOP STREAMING SHOP

Questions or comments? Please write to us here.

- Content:

- Content:

– Content:

– Content: