Paramount Stock Plunges as Skydance Merger Falls Apart

By Movieguide® Contributor

Following the breakdown of Paramount’s merger with Skydance, the company’s stock fell below $10 for the first time since Viacom and CBS merged in December 2019.

After months of talks about a deal with Skydance, Shari Redstone, Paramount’s controlling shareholder, withdrew the company’s option to merge with Skydance despite few options elsewhere.

“Without a deal the public now owns a company with: 125% of its EBITDA (earnings before interest, taxes, depreciation, and amortization) coming from the shrinking linear TV business, and the majority of that form general entertainment cable networks; a new 3-person office of the CEO; another round of cost-cutting coming; a likely change to its streaming strategy; and employee base that has already endured 6 months of uncertainty; little appeal for most agents and producers to bring their best material to; a possible rift with the co-producer of its tent-pole films, leverage over 4x and likely to creep up,” said Alan Gould of Loop Capital in a report.

“We assume PARA intensifies its focus to generate cash. At the annual meeting the tri-CEOs announced a $500 million cost-cutting initiative,” he continued. “They will try to find a partner for the streaming business which lost $4.5 billion over the past three years and is projected to lose another $0.9 billion this year.”

The company is still courting deals from Sony, Peacock and Warner Bros. Discovery. However, none of these mergers are currently under serious consideration.

While Paramount’s streaming services — Paramount+ and Pluto TV — have over 71 million subscribers and have landed hit shows such as KNUCKLES, HALO and SURVIVOR, the company’s financial problems continue to cast doubt on its future.

At the beginning of the year, former CEO Bob Bakish revealed Paramount’s plan for 2024, while blaming the company’s struggles on problems that have affected the entire market. He promised major cost-cutting while continuing to move the company’s content from linear media to streaming, but the measures haven’t yet saved the sinking ship.

Movieguide® previously reported:

Paramount’s CEO, Bob Bakish, revealed the company’s plans for the upcoming year, revealing a continued focus on finding profits through strategic marketing and staff cuts.

“We’re unleashing the power of our content, which remains our mission no matter what challenges we face,” Bakish said. “As an industry we’ve confronted a soft ad market, a volatile macroeconomic environment and two historic strikes just in the last year. All while navigating the ongoing evolution of the streaming business, as industry sentiment and metrics for success continue to shift.”

“And we’ve been on our own journey as a company – to realize the full potential of One Paramount as we transition our business from linear to streaming, and continue fine-tuning how we window and monetize our content,” he continued.

Bakish went on to explain how the company would continue to grow throughout 2024 as Paramount looks to improve its profitability and grow its brand image.

“[Paramount will] continue to maximize our global hits across multiple platforms and revenue streams – including streaming, film, TV and licensing – for the biggest return on our investment,” Bakish said.

Questions or comments? Please write to us here.

- Content:

- Content:

– Content:

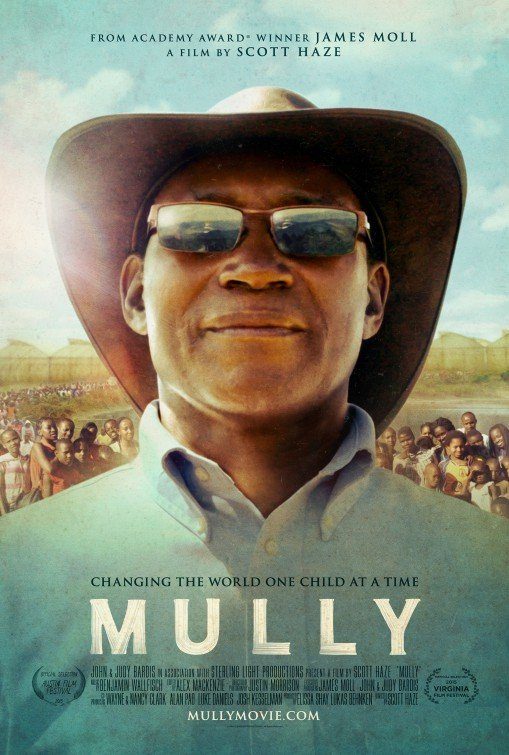

– Content: